Boost Your Credit Score: Unlocking the Path to Financial Freedom ===

In today’s world, having a good credit score is vital for financial success. It not only determines whether you can get approved for loans and credit cards but also affects the interest rates you receive. A high credit score opens doors to better financial opportunities, while a low one can close them. If you’re ready to take control of your finances and unlock the path to financial freedom, then boosting your credit score is the key you need.

The Key to Unlocking Financial Freedom: Boost Your Credit Score

Your credit score is a three-digit number that reflects your creditworthiness. Lenders use this number to evaluate your ability to repay borrowed money responsibly. The higher your credit score, the more likely you are to be approved for loans and credit cards. Additionally, a higher credit score often results in lower interest rates, saving you money in the long run.

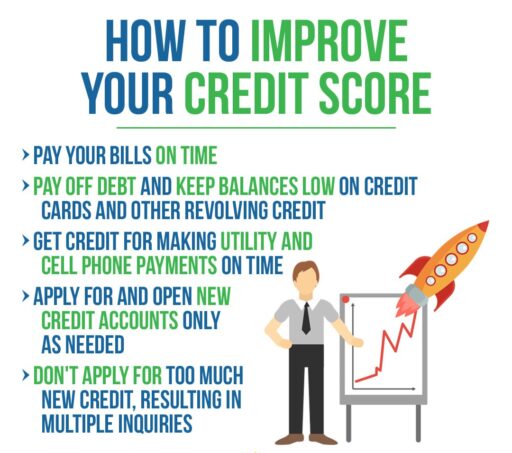

To boost your credit score, start by paying your bills on time. Late payments can significantly damage your credit score, so it’s crucial to prioritize timely payments. Set up automatic payments or create reminders to ensure you never miss a due date. Another strategy is to keep your credit utilization ratio low. This ratio compares the amount of credit you have available to the amount you are using. Keeping it below 30% shows lenders that you are responsible with your credit.

Discover the Path to Financial Independence through a Higher Credit Score

A higher credit score not only enables you to borrow money at better rates but also provides you with a sense of financial security and freedom. With a high credit score, you are more likely to be approved for a mortgage, allowing you to purchase your dream home. You also have a greater chance of qualifying for a car loan, helping you acquire reliable transportation. Moreover, a higher credit score can result in lower insurance premiums and even job offers, as certain employers may consider credit history when making hiring decisions.

Apart from making timely payments and keeping your credit utilization low, there are other ways to boost your credit score. Regularly check your credit report for any errors or discrepancies that could be dragging your score down. Dispute any inaccuracies you find and work with credit bureaus to have them corrected. Additionally, avoid opening unnecessary credit accounts, as each new account can temporarily lower your score.

By taking the necessary steps to boost your credit score, you can unlock the path to financial freedom. With a higher credit score, you can enjoy improved access to loans, lower interest rates, and a greater sense of financial security. Remember, building a good credit score takes time and effort, but the rewards are well worth it. Start today, and watch as your credit score opens the doors to a brighter financial future.